Fund a higher percentage of directly approved automobile loans.

OFFER YOUR MEMBERS A FASTER, SIMPLIFIED AUTO BUYING EXPERIENCE WHILE INCREASING YOUR

"DIRECT" LOAN FUNDING PERCENTAGE.

"Funding 67%+ of Directly Approved Auto Loans on average at Participating Credit Unions."

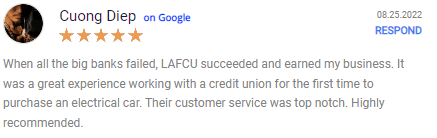

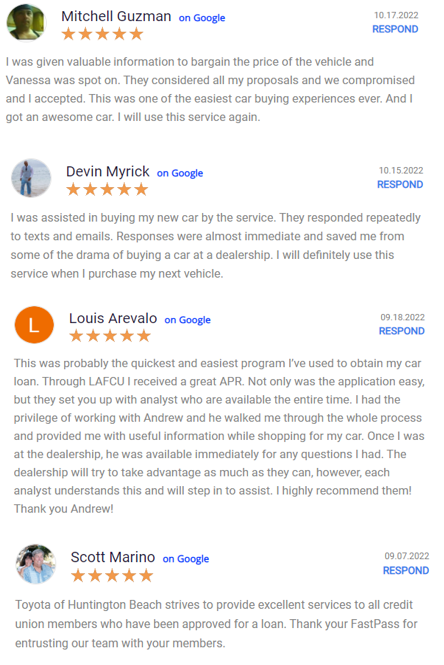

LOANIFYs' FastPass Program systematically bypasses standard Dealership processes, saving Members hours of valuable Time and Money while receiving the benefits of using their credit union auto loan directly.

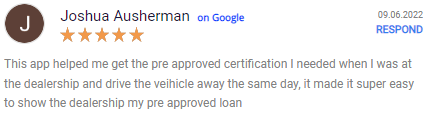

Mobile Member Support

FastPass unified messaging between the member auto shopper, their credit union lender, and dealership(s) allows for seamless deal processing on all sides of an automobile transaction. Clear communications create a winning collaboration.

Dealers Loan Info.

FastPass Mobile Auto Loan Certificate makes is easy for members to click a button to present their auto loan details the the dealership when they are ready to purchase, ensuring reduced offers from the dealership of alternative financing!

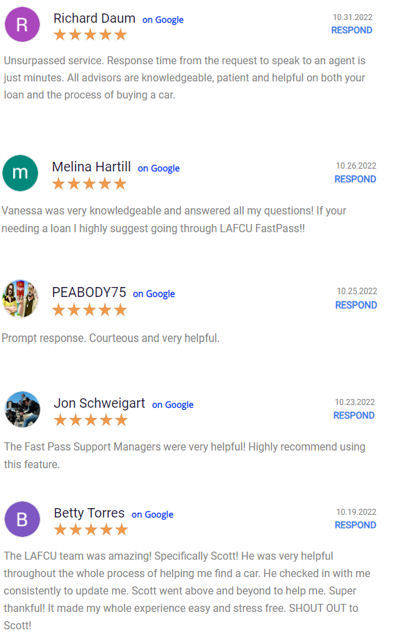

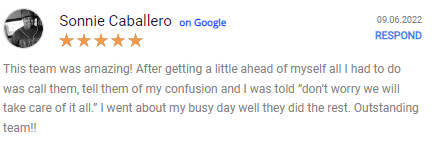

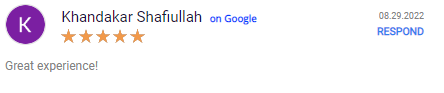

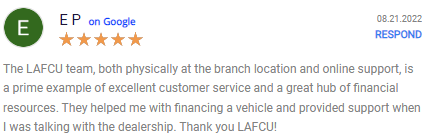

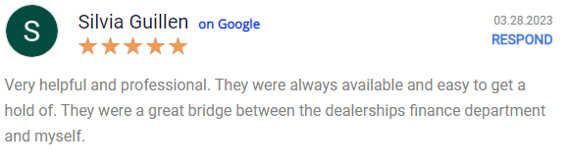

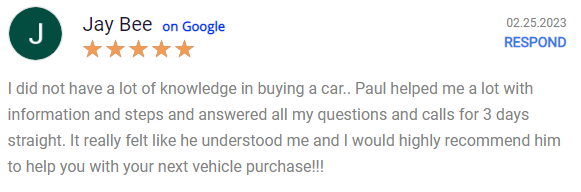

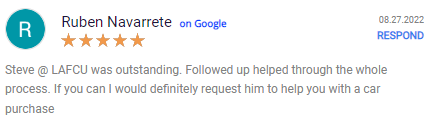

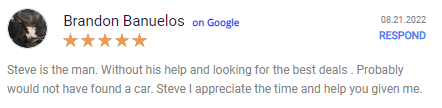

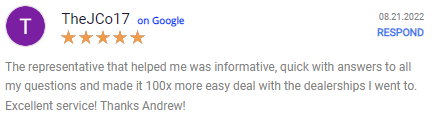

Shopper Support

FastPass Advisors are automobile professionals working on behalf of member shoppers, 7 days a week, including holidays. Advisors help members use their credit union auto loan at the dealership.

Andrew manages our team and supports members with his 10 years of experience new car dealership finance manager and general sales manager.

Dealer Partnerships

Authorized franchise dealerships plug into LOANIFY in order to receive qualified referrals from credit union participants. In exchange, dealers agree to reduce offers of alternative finance.

CONTACT

LOANIFY, Inc.

7500 Rialto Blvd. Suite 250

Austin TX, 7873500

Direct: (213) 651-3463

support@LOANIFY.net

Kirk

PRIVACY POLICYew Paragraph